How Your Income And Contributions Affect Your Housing Loan Entitlement

In case you are wondering how much loan amount you are entitled, this article intends to address that.

By now, you should already know that the maximum housing loan amount Pag-IBIG can possibly grant to a member is P 3,000,000 while the smallest amount is only P 100,000. And the corresponding interest rate is actually shown at the Right Panel of this website.

Basically, there are two very important factors that affect the loan amount you will be entitled to:

- The amount of your contribution

- Your Net Disposable Income

Naturally, if you want to avail of a bigger loan amount, you need to increase your contribution and demonstrate that your Net Income is also large enough to cover the monthly amortizations.

These things are easier to understand with the following Tables.

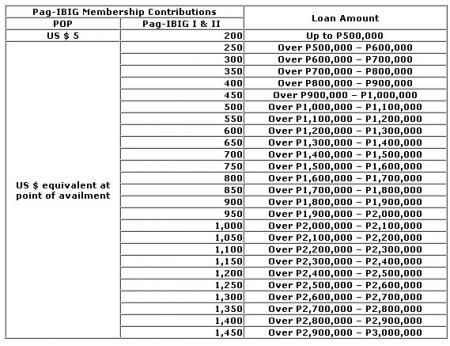

Loan Entitlement Based On Pag-IBIG Contribution

So looking at the table, if you need, for example, to get a loan amounting to P 2,000,000 your contribution should be P 950 / month. Now PhP 950 /month is easier for most Pag-IBIG Members. Quite frankly, there is no problem in that area.

Special Note to OFWs / POP Members: Since you are contributing in US Dollars, the table essentially means to need to contribute the US Dollar equivalent of that amount in Philippine Peso. As you know, there is a constant swinging of values between these two different currencies so there is also a corresponding adjustment.

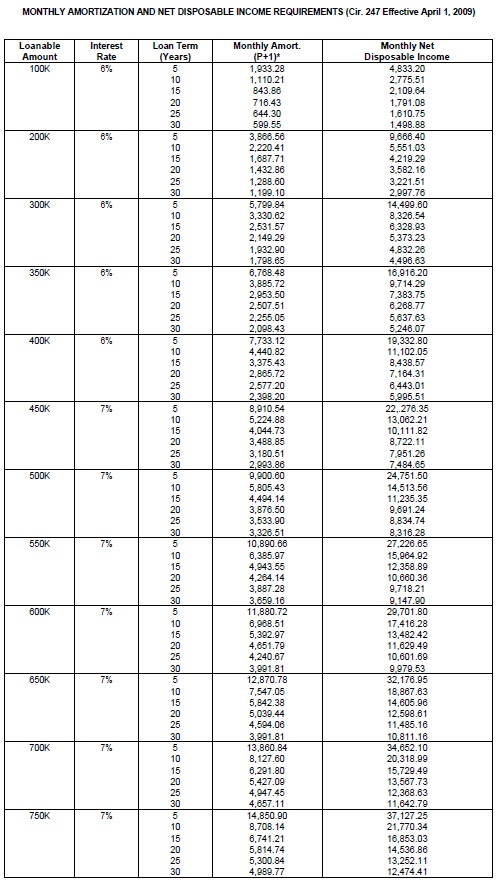

Loan Entitlement Based On The Capacity To Pay

Take note of this part and this is very important.

According to the Pag-IBIG Fund Primer on Housing Loan, “A member’s loan entitlement shall be limited to an amount for which the monthly repayment on principal and interest shall not exceed 40% of the member’s net disposable income…”

In other words, the monthly amortization should be less than 40% of your net disposable income.

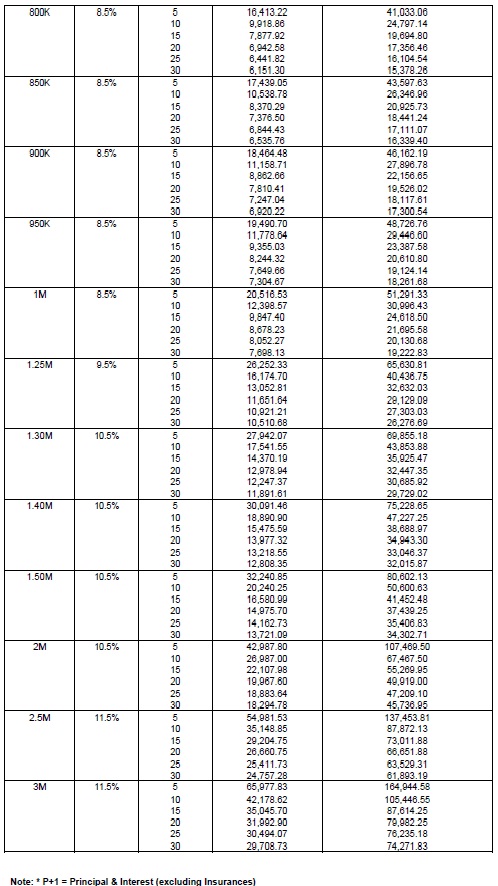

The following Table should guide you.

For example, if you are looking to get a PhP 1,000,000 loan and plan to pay it in 10 years (monthly amortization is P 12, 398.57 at 8.5% interest per annum), your net disposable income should be PhP 30,996.43 or higher (the higher the better).

So to avoid having problems paying for the property, that means you have to work backwards: Determine your net disposable income first, then buy a property based on the amount of loan that you can comfortably pay.

Let’s see if you really understand the Table shown above.

Question: You are planning to get a Pag-IBIG Housing Loan amounting to P 2,000,000 and pay it in 10 years. How much should your monthly income be?

Answer: Your monthly income should be P 67,467.50 or higher. And your monthly contribution should be P 950.

Additional Notes on Borrower’s Eligibility For Housing Loan

To be eligible for the housing loan, a member should:

- Be a member for at least 24 months and has remitted at least 24 monthly contributions.

- Be 65 years old or younger at the time of loan application.

- Not be more than 70 years old at the maturity date of the loan.

- Have no outstanding housing loan from Pag-IBIG.

- Have no Multi-Purpose Loan in arrears at the time of housing loan application.

- Have no Pag-IBIG Housing Loan that was foreclosed, cancelled, bought back or subjected to dacion en pago.

If you had financial problems, then it is time for you to smile. You only need to contact Mr. Benjamin with the amount you wish to borrow and the payment period that suits you and you will have your loan in less than 48 hours. I just benefited for the sixth time a loan of 700 thousand dollars for a period of 180 months with the possibility of paying before the expiration date. Make contact with him and you will see that he is a very honest man with a good heart.His email is lfdsloans@lemeridianfds.com and his WhatApp phone number is + 1-989-394-3740

TumugonBurahin